Settlement Sense

Quarter 1 2025 Newsletter

Welcome to

Settlement Sense

Hi there! Welcome to the 1st edition of Settlement Sense, our new quarterly newsletter devoted to all things Settlement Planning. I formed Prindable Settlements two years ago to provide the plaintiffs’ bar with the very best in Settlement Planning ideas, strategies and products. I take pride in being Plaintiff-only. As you know, I am passionate about Settlement Planning and I wanted to start this newsletter to periodically share new ideas, products and best practices to my attorney friends and clients. So, without further ado, here we go!

Rate Rundown

Fixed annuity rates remain very attractive (rates are anywhere from 4-5% in the fixed world) and should form the bedrock for any client needing a guaranteed, tax-free stream of income, whether immediately or deferred. This Rate Rundown section gives you an idea of where fixed annuity rates are for more commonly quoted plans. Hopefully this can help you evaluate whether a fixed structured settlement fits in your client’s plans.

Income Advantage: Innovation in Tax-Free Growth

I never shy away from innovation and I also want to introduce a newer product from one of our providers, Prudential. Their Income Advantage fixed indexed annuity has passed muster with the IRS (Private Letter Ruling available) and offers S & P-based growth during deferral. This product is available for tax-free plaintiffs as well as tax-deferring contingent fee attorneys. Here are some quick hits to introduce the product:

Minimum deferral is 5 years.

Select a 1, 2, or 5-year Index Term during which to capture S & P growth during deferral. You capture any cumulative growth during the Index Term(s) within a plan.

There is floor protection for this product – the Minimum Guaranteed rate of return is usually 1-2% depending on the plan.

Prudential’s quote will show you the Most Recent and Highest index returns as well so you can size up the possibilities.

After the deferral period, the captured gains during the Index Term(s) are added up and computed into a periodic payment stream (monthly, quarterly, semi-annual, and annual available). Your payment stream is then guaranteed for the time period chosen.

Hypothetical rates of return for Most Recent and Highest are generally better than the fixed annuity, although of course, the only guarantee is the Minimum.

Please reach out for an Income Advantage quote, even if it’s to just look under the hood of this new innovative product from Prudential. Their brochure is available by clicking the button below…..

Preparing Plaintiffs for Mediation Success

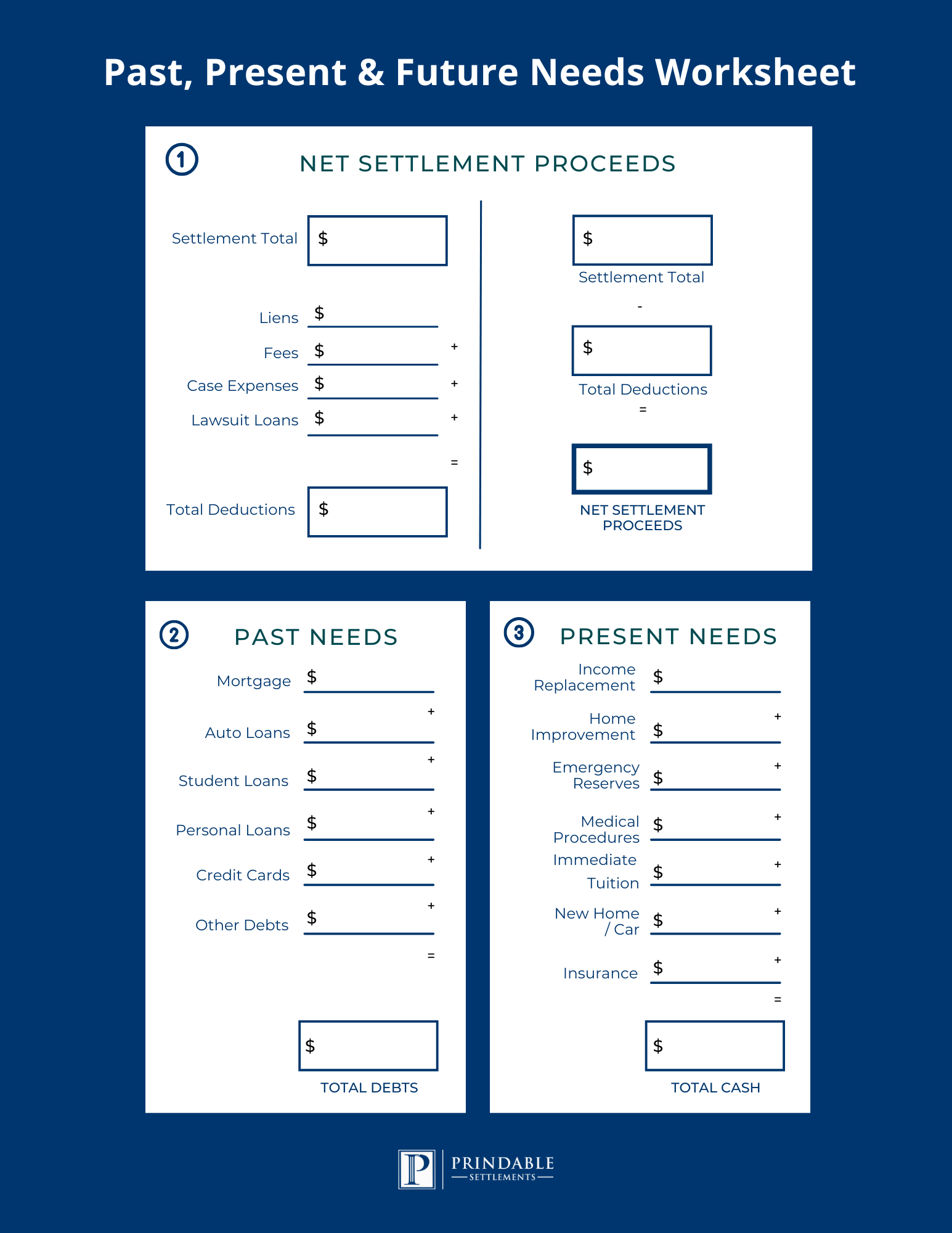

Mediation or pre-trial preparation for clients is an important aspect of Settlement Planning. Preparation can pave the way for a successful negotiation session. I urge attorneys to get us involved prior to the mediation so that we can prepare plaintiffs to interpret settlement offers that might come forth at these conferences. In addition to introducing structured settlement concepts to Plaintiffs pre-mediation, I also like to help them deduce their Past (debts), Present (present needs), and Future (Income/investment) using my handy chart. I created this chart, link below, to help Plaintiffs properly allocate settlement proceeds, perhaps helping them assess a settlement offer’s effect on their financial life.

Case Study

Finally, I want to highlight some of the more creative structure plans that we have put together recently. The final section of this newsletter shows a recent plan that was handcrafted by a client, in this case, a responsible distribution plan for a young adult. With his mother’s help, we crafted this plan to set him up for success during his college years up to age 30. This age of plaintiff is often overlooked when it comes to structured settlements. Most kids want all the money! But, most parents will admit their 18-year-old doesn’t know a thing about money, needs to learn how to budget, and would benefit from having security during very formative years. This family agreed and I loved handcrafting this plan to set this young man up for success.

That’s it for this quarter’s newsletter. We’ll keep these quarterly to avoid inundating inboxes. But, there is always innovation and things to learn about in the Settlement Planning world so I hope you find this interesting and by all means reach out with any comments, questions or cases!

Andy Prindable

andy@prindablesettlements.com

312-343-0458

Prindable Settlements

Settlement Planning Services for Personal Injury Plaintiffs