Settlement Sense

Quarter 3 2025 Newsletter

Welcome to

Settlement Sense

As summer winds down, the heat cools off and schools open back up, 4th quarter looms. Law firms and insurance companies are often inspired to move cases before the year’s end. There are tax implications for contingent fee attorneys and law firms; potential write-offs for defendants and insurers. Settlement discussions heat up, mediations get scheduled and there is always a flurry of activity in the Settlement Planning and Structured Settlement world. Labor Day to Christmas is always a sprint. With that stage set, this 3rd edition of Settlement Sense is focused on educating you on your options as cases resolve in 4th quarter:

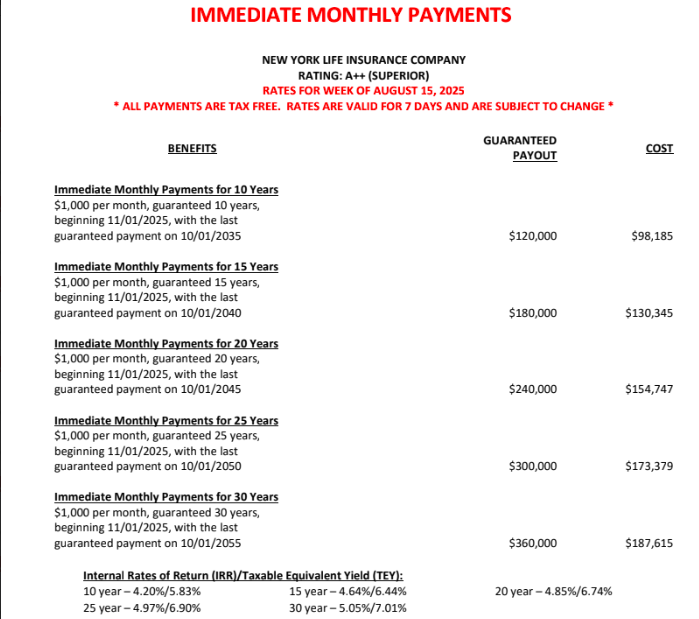

Rate Rundown

Rates are still great! As you’ve seen in the news, the markets have weathered the tariff storm and plowed on ahead. The 10- and 30-year Treasury Yields, which somewhat dictate fixed structured settlement rates, have remained strong. In fact, rates have even improved slightly since our last check-in in May. Below please find a link to the latest Rate Rundown that displays current rates on popular plans and payment streams. You’ll also notice a new provider’s rates – more on that below!

New Providers, Strong Rates: ANICO & Athene Arrive

The structured settlement industry has welcomed two new life insurance company providers to the space! Both American National Insurance Company (ANICO) and Athene Annuity and Life Company (Athene) have decided to start writing fixed structured settlement annuities. And, their rates are incredible – you can get a glance at sample ANICO rates from the Rate Rundown above.

ANICO is rated A (Excellent), Class XV, by A.M. Best, the ratings company that rates life insurance companies on their ability to meet ongoing obligations to customers. ANICO has held this rating for 85 consecutive years! They have over $2 billion in surplus and are owned by Brookfield, with over $1 trillion in assets under management.

Athene is rated A+ (Superior), by A.M. Best, is the #1 provider of retail annuities in the country. They are a subsidiary of Apollo Global Management and have net invested assets of $249 billion.

You will start to see both of these companies inserted into our Rate Comparison Matrix when we shop for daily rates on structured settlement plans. In fact, you will probably see them at the top of most lists – they have entered the marketplace swinging. Marketing and financial strength information is of course available upon request.

Attorney’s Fees

As I’m sure you’ve heard me mention many times, 4th quarter is for fee deferrals!

Contingent fee attorneys have the unique ability to defer their tax obligation on fees if done at the time of settlement. Essentially, the terms of the Release split-out any deferred fees, direct them as payable to the attorney and/or firm in the future and the net effect is pre-tax growth of your deferred fees. You will pay taxes on the money received in the future, so it’s not a loophole, you are just kicking the can down the road. The IRS challenged this practice in the 1980’s and lost.

Fee deferrals are a very powerful opportunity for contingent fee attorneys. Most often, they are used for retirement purposes – setting yourself up with guaranteed payments from age 60 – 70 or 75 can help bridge the gap to retirement. Your other retirement vehicles can keep cooking, without withdrawals, until you have to take required minimum distributions. Use the fee deferrals for income.

But, you could also use a fee deferral for tax purposes, deflecting some income into future years. Contingent fee attorneys can have their up and down years, cases can settle at unpredictable intervals. Rates are good enough right now for short term deferrals, you could set up a plan to just pay you quarterly for a few years. Or, perhaps you just want to provide guaranteed overhead for your firm – a fee deferral can be done at the law firm level too, not just an individual attorney.

The slides below go into more detail on your fee deferral options. I also have a home-spun white paper that answers all the FAQ’s, please reach out if you’d like to take a deep dive.

That’s it for this quarter’s newsletter. Fourth quarter will be busy! I hope you find this interesting and by all means reach out with any comments, questions and/or cases!

Andy Prindable

andy@prindablesettlements.com

312-343-0458

Prindable Settlements

Settlement Planning Services for Personal Injury Plaintiffs