Settlement Sense

Quarter 4 2025 Newsletter

Welcome to

Settlement Sense

Welcome to the 4th and final edition of Settlement Sense, our quarterly newsletter. In this quarter’s issue, we focus on the following topics:

- Rates

- Non-Qualified Structured Settlements

- What’s in a Quote?

- Plan example – bond-type payout

Rate Rundown

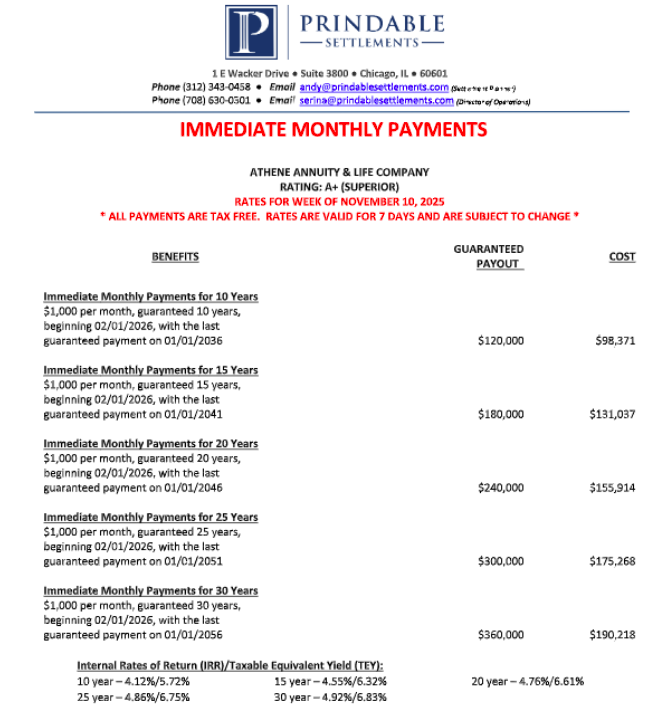

Fixed annuity rates have dipped a little bit from summer highs, but we are still firmly in the high 4% range, with 5% rates of return still available on longer-term structured settlement plans. Below, please find a link to the latest Rate Rundown that displays current rates on popular plans and payment streams. For this quarter’s edition, we’ve used the rates from one of our new providers, A+ rated Athene Life & Annuity Company. Athene consistently has had some of the best rates in the marketplace since entering the structured settlement world mid-summer 2025.

Non-Qualified Structured Settlements (NQSS)

We put a lot of work into our latest marketing piece, a handcrafted white paper encompassing all things Non Qualified Structured Settlements. You can find it here via this link – An Attorney’s Guide to Non-Qualified Structured Settlements.

NQSS

These NQSS are applicable to taxable settlements, those settlements that don’t fall under the IRS protection of tax-free on account of physical injury. There are more taxable claims than you think – non wage employment cases, divorce cases, emotional damages, libel/slander, construction defects, legal malpractice – among others.

A NQSS requires the same language, payment stream delineation and money transaction as a tax-free structured settlement. We need the defendant or their insurer to pay for the NQSS. The benefit to the client (or attorneys for fees) is tax deferral on the amount structured as well as pre-tax growth on the structured funds. The client or attorney only pays taxes on amounts paid out in future years. A NQSS can be very useful to spread out a large tax hit, provide immediate guaranteed income or to prepare for future, deferred needs.

Many of the same providers in the tax-free world also provide NQSS. Fixed annuity providers like Met Life, Athene, American General and Independent Life offer NQSS. Independent Life has a fixed index annuity. Market-based options are also available, where you can build your own portfolio of investments to grow during deferral. Just like with traditional, tax-free structured settlements, it is important to get us involved prior to the NQ case settling, so we can survey the client’s options, provide guidance and set up the paperwork and money transfer for a NQSS. Call us today to learn more about this powerful settlement option!

What’s in a Quote?

This is a new feature where we explain key aspects and definitions of fixed annuity quotes. To start off, let’s define two main types of payment streams that are available for structured settlements, whether the payments are immediate or deferred.

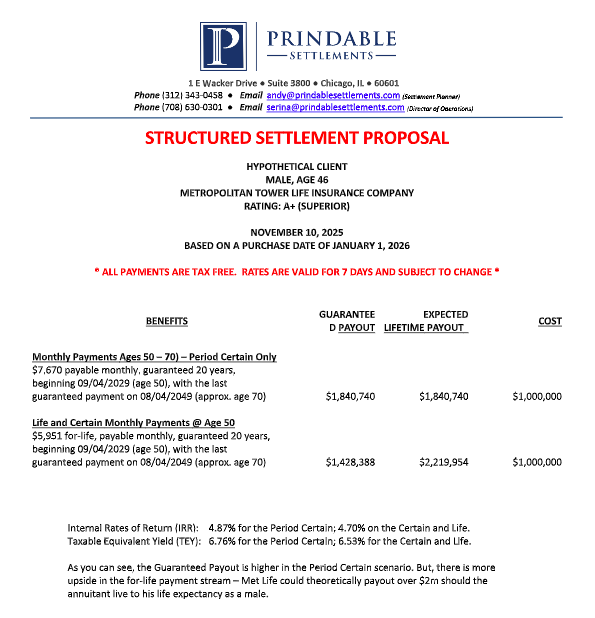

Period Certain. This is a specifically defined benefit stream. Or, in other words, there is an absolute certain period of time that the payment stream is going to run. There is a definite start date and a definite ending date. For instance, when you hear us say a “immediate 20 year PC”, that means that we are showing you a payment stream that starts immediately and ends after 20 years, no matter what. Payments are guaranteed to the payee AND any beneficiaries during the 20-year period certain payment stream.

Life and Certain. This benefit stream adds on to the Period Certain by also guaranteeing payments for an annuitant’s lifetime. So, there are two guarantees in a Life and Certain. One, the life insurance company is going to guarantee the payments for as long as the annuitant lives. Two, the life insurance company is also going to concurrently guarantee benefits for X years at the beginning, to ensure that the annuity makes money and protects beneficiaries from the premature death of the annuitant. The pricing on a Life and Certain benefit stream is most definitely based upon a person’s date of birth, gender as well as any mortality issues – age rating (shortened life expectancy) is going to affect rates.

Any for-life benefits are going to cost more to provide than Period Certain benefits. This is because in a for life scenario, the life insurance company has to hedge to pay the annuitant for as long as they live – which could exceed life expectancy. In a Period Certain payment stream, the life insurance company knows it has to pay out X for Y years, no matter what and independent on who they are paying (payee or beneficiary). Hence, in a side-by-side comparison, you will see the Period Certain provides a larger payment and usually a larger Guaranteed Payout. But, with a Life and Certain quote, you will see a larger Expected Lifetime Payout – the annuitant could garner more benefits the longer they live. Here is a side-by-side comparison, for your perusal:

What’s in a Quote?

When I am in living rooms meeting with potential annuitants, I am often asked which option is better, the Life and Certain or the Period Certain. I always reply that it is an individual decision – if the for-life guarantee provides that client with the peace of mind of knowing they can’t outlive their benefits, then the for-life guarantee is worth every penny!

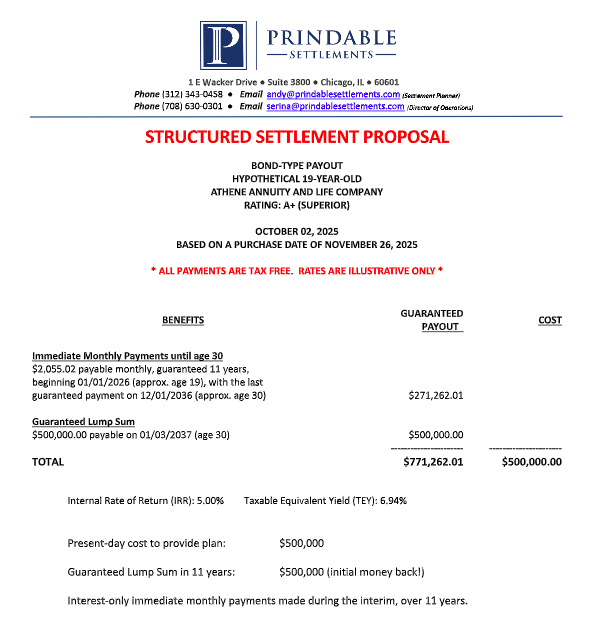

Plan Example – the Bond-Type of payout

A popular structured settlement plan that many younger people prefer is a bond-type of payout. That is, we set up a plan so that the annuitant gets their money back at the end of the chosen term, say 10 or 15 years. Then, we run an immediate monthly payment stream using the extra money available. So, in essence, the client is living off of the interest during the monthly payment stream. At the end of the term, they get their money back that they initially placed into the structured settlement. This is a great way to provide two things – immediate tax-free monthly income for X years, then a tax-free, guaranteed lump sum at the end of the term!

That’s it for this quarter’s newsletter. As you can tell, we have so much to talk about in the world of settlement planning and structured settlements. More to come in 2026. I hope you find this interesting and by all means reach out with any comments, questions and/or cases!

Andy Prindable

andy@prindablesettlements.com

312-343-0458

Prindable Settlements

Settlement Planning Services for Personal Injury Plaintiffs